January

12

January

12

Tags

Buying a Bank Stock? Read This First

They have the same tickers and familiar logos but banks sure aren’t the same companies of years past. Gone is the staggering Return on Equity (ROE) and huge trading gains that became the hallmark of firms like Goldman (GS), JP Morgan (JPM)* and others.

Make no mistake, these mammoth institutions still command lots of power and have grown larger even in the face of “Too Big to Fail.” However, despite efforts to hold back the tide a secular shift turning Banks into Utilities is well under way.

The Home Run

Coming out of the financial crisis banks and a host of other financial service companies offered the home run trade. Priced for extinction, all they had to do was survive to offer staggering returns. Here we are 5 years later and the financial sector is showing some signs of fatigue.

The rise of Dodd-Frank and other legislation like the Volcker rule designed to prevent systemic risk is step by step stripping banks of profit centers they’ve long enjoyed. The Volcker Rule named after former Fed Chair Paul Volcker sought to reduce speculative bets made by banks that sit at the very heart of proprietary trading or prop trading as it’s known in the industry.

Last month, Wall Street scored a legal victory when the Fed agreed to delay part of the rule giving banks two more years to sell off investments in private equity and hedge Funds. For other parts of the Volcker Rule a 2015 deadline is fast approaching. i expect lobbying efforts to intensify especially as we get closer to the 2016 Presidential election cycle.

Even outside the confines of Dodd-Frank, banks are being forced to raise more capital. Chief Economic Adviser of Allianz, Mohamed El-Erian points out recently; The U.S. Federal Reserve’s proposal for a new capital surcharge on “global systemically important banking organizations” (or GSIB’s) has triggered lots of speculation on how individual institutions will respond over time. He goes on to say; some believe JP Morgan (JPM) might face a $22 Billion shortfall.

Justice

The Federal Justice system along with every State Attorney General who can tag along has been using the banks as their own personal ATM. I’m not sure anyone really knows the total amount of fines paid by banks since 2008 but press reports show the range anywhere between $184 Billion and $300 Billion.

The massive fines have been a political success but a consumer failure. The role of justice is to root out criminal activity, bring those responsible to justice and help insure that it doesn’t happen again.

Incarcerate or fine those responsible and I guarantee you’ll reduce the chances of a repeat performance. The fines have hit the pocket books of shareholders but to date I haven’t seen any perp walks.

So far investors have treated the fines as one off events believing it’s just a matter of time for business to pick up or the yield curve to normalize. However, many including yours truly are starting to question their commitment to a sector that seems increasingly challenged and heavily regulated.

Declining Return on Equity (ROE)

Bank Earnings on Deck

Alcoa (AA) kicks off the earnings season this week but the focus will be on Wednesday when JP Morgan (JPM) and Wells Fargo (WFC) both report before the opening bell. Citi (C) and Bank of America (BAC) follow Thursday with finally Goldman Sachs (GS) on Friday.

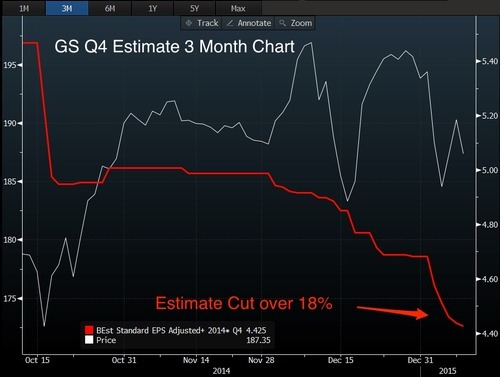

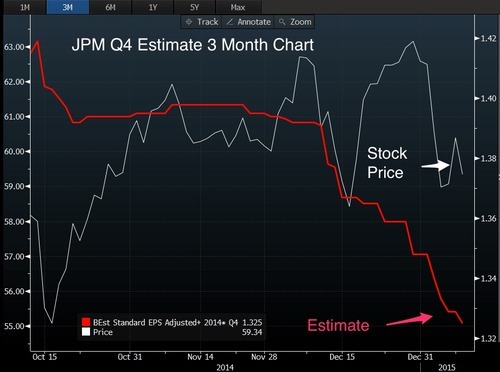

The charts of estimate revisions during the last 3 months all look the same. Analysts have lost confidence in the quarter cutting estimates consistently including dramatic cuts like Goldman where consensus has fallen more than $1 dollar from 5.40 to 4.40.

I could put up several more charts including BAC, C and WFC but the pictures all tell the same story.

Even analysts who remain constructive on Banks for 2015 point out that Q4 fundamentals are challenged. A likely source of the negative estimate revisions comes from trading. In a recent banking conference, CEO’s from Bank of America and Citi said they expect trading revenue to be lower.

Energy stocks along with their debt have taken big hits in the face of collapsing oil. It won’t be a surprise to eventually see some of this bad news eventually make its way to the banking sector. (Read Oil & The Black Swan)

Finally net interest margins which were expected to improve may see that opportunity delayed with uncertainty surrounding an eventual normalization of the yield curve.

Pops & Drops

The pops and drops this week following bank earnings will be more a reflection of the accuracy of analyst estimates than a vote either way by shareholders. Did they cut estimates enough or are they overly pessimistic. Given the challenges, I doubt even management can give you an accurate picture of what to expect in 2015.

No Longer Growth Stocks

There’s a place for bank stocks in your portfolio but it isn’t in the growth basket. At the right price they are value stocks with potentially growing dividends and return of capital. Increased regulation comes at a cost and lost profit centers will have to be replaced to approach the growth in years past. Until then, banks look very much like utilities.